The Digital Age: Payments with Digital Wallet

The online environment and use of mobile payments for in-person transactions has changed how transactions are being made. New technologies are changing the way we view the transaction process as well as how we exchange money for goods and services. By incorporating these new ways to make safe and secure payments, businesses are able to expand their customer base and client portfolio.

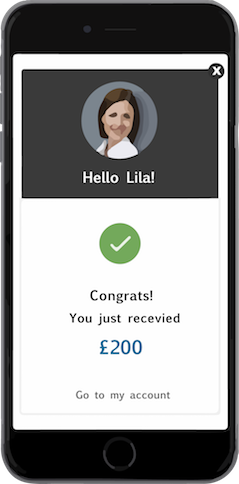

Now, new technologies have opened up new payment methods at low-cost transaction rates so more freelancers and small business owners can accept credit and debit cards, use ACH and eCheck systems, incorporate digital wallets and even expand into new payment methods like cryptocurrency and eCash. To help you leverage the opportunities to attract more customers and clients who are seeking to use these types of payment methods, Cari offers a payment product designed to connect, share, and make payments possible across all platforms.

Digital wallets are providing a way to use smartphones as a wallet rather than to carry around physical forms of payment that put you at greater risk for theft or fraud. Along with debit and credit card information, these digital wallets are made to store loyalty cards, membership cards, and more. As a business owner, the ability to offer a digital wallet system for customers puts you at the forefront of your industry, giving you an advantage over the competition. You’ll be able to deliver greater convenience, security, and value by incorporating the digital wallet feature, helping customers make and share payments.